You need someone able to explain your numbers to you in a concise and life-giving way. Joshua Gordon is a lay-pastor, author, and editor of TheLeadPastor.com. Over the last two decades, Josh has worked closely with pastors and other christian leaders, helping them to sharpen and elevate their messages. Today, Joshua pastors at New Life Fellowship, a thriving church he helped plant in Cambridge, Ontario, Canada. But it’s important to choose https://www.bookstime.com/ a platform that empowers you to get started on the right foot.

How to Set up QuickBooks for Nonprofits: The Complete Guide

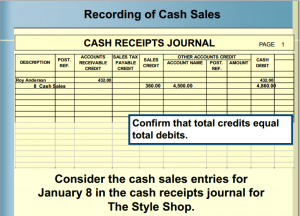

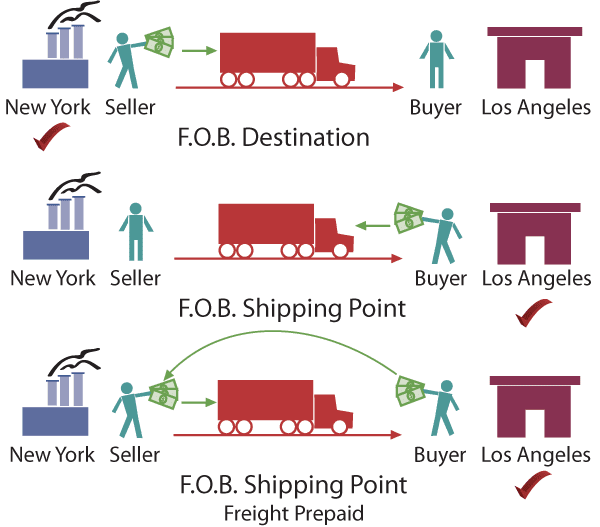

Stewardship is rooted in the constant work to trust Jesus as provider . Policies and procedures around payment and bill pay keep individuals from making errors while keeping the church above reproach. The accounting codes, receipts, and amounts are all applied evenly and correctly across platforms. Then, you reconcile BILL monthly to ensure every invoice you think got paid did get paid.

How Long Should A Church Keep Financial Records?

Your quality bookkeeping provides you with https://www.facebook.com/BooksTimeInc/ the information, tools, and confidence to know the next best move to make. Once you capture all the details of your organization’s finances, it’s time to use what you learn to continue leading your church. Churches can plan for long-term financial stability through prudent financial practices and strategic foresight.

- In 2023, for example, the Employee Retention Tax Credit (ERTC) gave churches a pandemic-related employee tax credit that they could claim — if they knew about it.

- Any donations received that are earmarked for that charity must be given to them.

- Accountability is putting transparent financial reporting procedures and supervision frameworks in place to guarantee that money is spent where it must be.

- They juggle responsibilities that stretch far beyond Sunday morning services.

- For instance, a well-oiled church accounting machine can adapt to (and take advantage of) online donation methods.

- The entire focus of a church, as far as accounting is concerned, is to properly shepherd funds to the right places.

Fund Accounting For Churches: Key Principles And Best Practices

You can choose what level of access each team member has to the information provided in a given payment request, so the youth pastor and the worship pastor don’t necessarily have access to each other’s expenses. But when churches abide by the rules of FICA for their ministers, they’re paying a tax not required by the federal government and withholding taxes ministers are not required to pay. Then, at tax time, ministers will still have to pay 15.3% of their gross income for SECA. From there, it’s up to you to get moving and start making the updates, changes, and decisions that will guide your organization toward continued financial success.

- However, we’ve found that most churches need at least some support when it comes to money management.

- The church accounting system is centered on advancing the mission and objectives of the church rather than generating profits.

- Utilize these metrics to realize insights for key financial decision-making like expanding programs, building new locations, or improving oversight on multiple locations.

- Implementing fund accounting on your statement of financial position and statement of activities will give a clear and precise snapshot of the church’s financial health.

Best church accounting software for payables

- You’ll also need an accountant to create financial reports and file taxes.

- ACCOUNTS by Software4NonProfits is one of the top accounting software solutions crafted exclusively for the accounting needs of nonprofits.

- Stewardship is rooted in the constant work to trust Jesus as provider .

- Since churches are classified as nonprofits by the IRS, many accounting practices are similar, but there are a few differences between the two.

- Ask them to submit their requests for financial support for the upcoming year and direct them to plan their spending in alignment with the year’s vision.

Extra benefits in a platform include giving tools and presenting your data concisely to those who have given. When it comes to filing with the IRS each year, churches can often have some of the most complicated returns out there. This is due to the rules around reporting revenue and expenses church accounting best practices for 501(c)3 organizations. Any money that enters the church needs to reflect on the organization’s tax forms in some way. For example, some people give money every month, and others give once or give in-kind contributions.